s-peek

more than just companies' data

Credit scores, credit limits and all the financial information you need, in a click

Know your customers, make informed decisions

s-peek is the first free web and mobile application that allows you to easily assess the economic and financial health of your own company and your customers, suppliers or partners.

Using s-peek is really simple: just write the name of the company you want to evaluate, and you will immediately obtain the credit score and all the data you need for testing its reliability.

MORE score

Get an immediate assessment of the company's financial health

Credit limit

Evaluate the annual commercial credit line that can be granted to the company

Negativities

Check if there are any protests or bankruptcy proceedings in progress

Public data

Access the last 3 publicly filed financial statements, whenever available

Accessible information, wherever you are

You are able to obtain financial information of customers, partners, suppliers and competitors from all over Europe, simply by entering the company's name or VAT number. You will be able to access all its credit information, its score, and all the economics and balance sheet data, within a few seconds.Just download the app for iOS and Android smartphones, or simply register online at www.s-peek.com.

Keep an eye on the companies you work with

You are able to create a portfolio of companies, to evaluate and monitor -you will continuously be informed of any available update as soon as published on any European Chambers of Commerce.Through a wide search engine, you can look for over 25 million companies, distributed throughout Europe, and monitor the entire portfolio from your personal app profile.

Credit risk analysis, accessible to everyone

You don't need to be an expert financial analyst to understand a company's health: thanks to s-peek, you can access detailed information and intuitive graphs, to get an overview of the companies that interest you.Textual analysis makes it easier to interpret the data, and a color chromatic scale (from green to yellow, and red) helps you to identify critical factors, to instantly obtain a reliability picture of your commercial interlocutor.Share financial evaluations with your colleagues

Collaborate with your team at work, and privately share company credit scores, add any note or comment, and view all the most interesting data in graphs, for an effective and immediate comparison.You can download companies' data in Excel format, to work on those information internally.

All this is available at the office and on the go, out for work meetings, on your computer and on your smartphone.

Choose the best quantity of information that suits your needs

You are able to choose among two different levels of financial information: Flash reports, with fundamental data, and Extended12M reports, with greater detail and monitored throughout 12 months.

No emails to send, zero waiting times: just search for the company, and deepen the analysis to access the economic and financial information.

Flash

you can find out the company's credit score, its commercial credit line, any available negativity, and compare the average data of companies in the same sector, in the last three years. It costs less than a coffee.Extended12M

in addition to the basic information, you can access the complete balance sheet, any shareholder and manager data, the company's Board of Directors, detailed negativities if any, and everything's monitored for 12 months.Curious about s-peek?

Simply digit s-peek on your browser, or download the app from your mobile store: credit card is not required for registration.

Know your customers' reliability within few clicks, make quick and informed decisions, work at your best.

s-peek on the web

Data and algorithms, via API

The entire s-peek database and algorithms' system is easy to access and integrate within your business suite, accessible through any programming language.

Just contact us to know more about it.

Get in touchWho is s-peek for?

s-peek is the ideal platform both for the consultancy world, and the small and medium-seize enterprises which have commercial relationships in Europe; plus, it's ideal for banks and Fintech companies operating in the SMEs credit market.

Also, but not limited to: if you are a professional, in any field, who is not used to interpreting company's financial data from balance sheets, you are able to use s-peek for a quick and easy-to-understand picture of your own customers and suppliers, based of official data.

SMEs and professionals

The evaluation of your company, plus any customer, partner, supplier and competitor. Knowing financials is an important advantage in terms of:

- immediate understanding of the degree of reliability of new customers, partners and suppliers;

- assessment of one's own economic and financial situation for access to credit;

- knowledge of the financial performance of competitors.

Banks and Financial institutions

The automation of integrated risk analysis on its information flows constitutes an important competitive advantage in terms of:

- reduction of internal processes for assessing the customer's economic and financial situation;

- sharing financial data and comments between team members.

How to find out

if your new customeris reliable?

Check instantly its economic and financial health: understand any customer, partner, supplier and competitor degree of reliability and financial solidity, throughout Europe.

FAQ

What is MORE?

Being modefinance a Rating Agency, MORE is our methodology for assessing credit risk, and can be represented both as a credit score and a Rating.

Based on Big Data and Artificial Intelligence, the Multi Objective Rating Evaluation is calculated using various innovative numerical methodologies, integrated with the most modern economic and financial theories, in order to obtain a credit risk assessment that is as coherent and transparent as possible.

The heart of the MORE model is a multi-objective and multi-dimensional algorithm that coherently aggregates the various aspects (quantitative, qualitative, economic and strictly financial) of the company analyzed.

What is the MORE Credit Limit?

The MORE credit limit is the estimate of the maximum amount of credit that can be granted in a commercial relationship to the analyzed company, in the time period of one year.

The MORE Credit Limit is the fundamental element for evaluating a customer's credit limit: in fact, it evaluates the maximum exposure that the company can receive.

Are s-peek ratings reliable?

Credit Scores in s-peek are published by modefinance, an officially recognized Rating Agency in Europe, which approached the traditional Credit Rating field with an innovative, AI-based system.

s-peek offers credit scores issued by modefinance which, since 10 July 2015, is registered as a credit rating agency in accordance with Regulation N. 1060/2009 of the European Parliament and of the Council, 16 September 2009 (Regulation of Rating Agencies of the Credit).

Where does the data come from?

Data are provided by official information distributors: each Country has a public institution entrusted with the collection of the annual financial statements of the companies operating in that country. These information are always captured from official balance sheet data, filed and verified. In some countries, where an official Central Data Source does not exist, the information provider may collect data directly from companies.

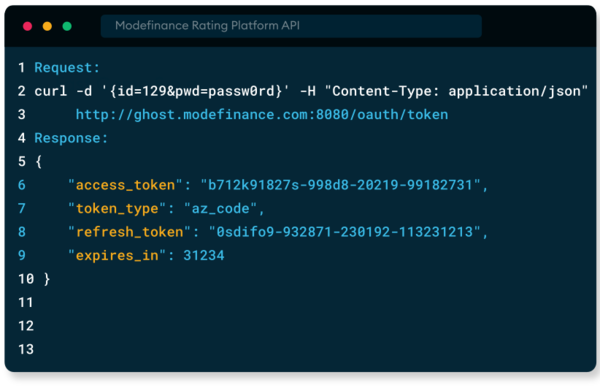

How to request s-peek services via API?

All the s-peek services (FLASH and Extended12M reports, and their information) are also available via API.

For more information on how to access and integrate these services via API, please contact us by filling up the online form, or via email at: technical.support@modefinance.com