Tigran key results

Tigran is a modular and customizable cloud platform for managing credit and financial risks. It allows to obtain important improvements compared to traditional methodologies, reducing decision-making times and costs.

TIGRAN

Numbers

X3

Accelerates customers' decision-making times

-38%

Reduces the assessment and analyses costs

ZERO

No more paper-based files and manual data processes

Credit Rating services, at your disposal

Tigran Risk Platform is the solution that integrates the functions and services of a Fintech rating agency into a modular web platform for counterparty risk assessment and investment and exposure portfolio management, dedicated to financial institutions, investment funds, Fintech companies and holding companies.

Say goodbye to paper-based, ever-lasting, prone to errors procedures

Tigran's modular structure overturns the traditional approach to credit risk management, offering everyone a flexible, adaptable and fully customizable solution that combines all stages of the decision-making process into a single framework, from pre-feasibility and due diligence to approval the final.

A credit risk management platform that fits your needs

InserireModularity

Models and functionality like bricks on a standardized basis

A single platform, the analysis tools you need: the Rating-as-a-Service within your reach, to automate the creditworthiness assessment process, offering you an intuitive framework for an immediate understanding of probabilities and to prevent situations of risk.

100% digital

Say goodbye to Excel, spreadsheets and lost paper documents

Real-time evaluation of companies and financial institutions in the portfolio and immediate understanding of risk factors, in a single digital cloud-based tool: automation, rapidity and reliability of integrated processes, thanks to a comprehensive and scalable platform.

Integration

Data, forms, and systems: all within your management reach

The enhancement of proprietary data and third-party sources, with the integration of quantitative and qualitative data, technologies and modefinance proprietary models: connecting Tigran with your management software is simple and prompt, and compatible with the major core business applications. Already a s-peek user? It is possible to integrate data, information and functions, for the best management of the process and the prediction of scenario analyzes. Node Integration with the most important international data providers, in order to guarantee the widest global coverage.

Tailoring

Your needs, a customized solution

The development of custom models, based on internal needs and policies, for the best assessment, management and prevention of risk. The forecast of expected losses and, in the event of insolvency, calculation of provisions. MORE ratings, sector comparisons and customized probability of default, with the support of consultants and developers. Portfolio risk assessment and simulation, cash flow analysis, stress testing, debt capacity and stability analysis.

Wide availability

At your desk or on the go, always by your side

Extremely responsive, Tigran can be used from any device, mobile or desktop, out of the office or at the desk: the interface is clear and intuitive, the response times are quick. You have the availability of information in digital format, via API and the possibility to download the reports in different formats (PDF or Excel).

Manage credit risk and assess creditworthiness

Speed up the analysis of exposure risk and counterparty creditworthiness assessments. Predict unexpected situations through a single data input and a single platform for their use with the customization of procedures and approval flows: you can analyze thousands of listed companies and millions of unlisted private individuals.

Make forecasts in the very short term and increase revenue thanks to leaner operations.

- credit scores

- probability of default

- cash flows

- Loss given default

- risk exposure

- value at risk

- expected losses

- feasibility rating

The tools to monitor and analyze credit risk

Credit rating

Easily assess counterparty creditworthiness and probability of default through MORE, our AI-based credit risk algorithm, and analyze the economic and financial situation of any company or financial institution in the world.

Forecasting and stress-testing

Determines the borrowing capacity of the counterparties. Run the stress test and budget simulation over 5 years according to different scenarios and predict the future behavior of companies based on their size, sector, position and financial history through our ForST model.

Portfolio risk analysis

Evaluate your portfolio on risk-adjusted measures, estimating the amount and distribution of expected losses, value at risk and default loss over the years.

Competitor's benchmark

Compare counterparties with peer groups, industries and sizes, and perform large-scale credit risk analysis within seconds.

Qualitative and sentiment analysis

Automate the analysis of qualitative data. Bridge the information gap between parties and nowcast scenarios not yet highlighted by market trends by integrating alternative data provided by non-traditional sources, such as news and social media.

Model and data customization

Add custom templates to your workflow and set them as analysis stages of the rating evaluation process. Models can be developed independently, or upon request.

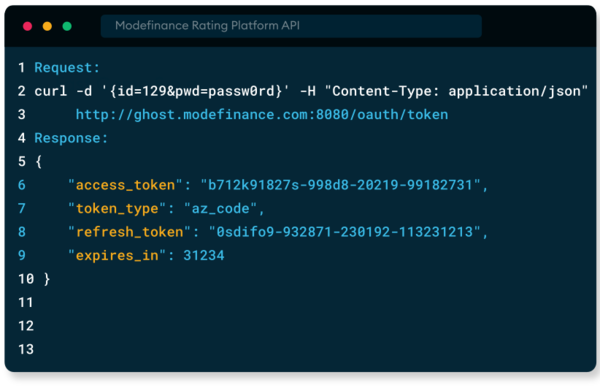

Data and models, also via API

modefinance supports connectivity: all tools are easily accessible and available via API. Proprietary analysis models and external sources of information can be integrated within the platform. All Tigran features are also available via API, reducing software development time and costs and additional features.

Find out moreWho is Tigran for?

Digitization and financial risk management through a single cloud platform that eliminates paper procedures and loss of files, allows you to optimize time and improve the productivity of your resources.

Whether it's a bank, an asset manager, managing savings or part of any credit institution, process automation with the Tigran Risk Platform allows you to have all the tools of a rating agency at your fingertips: a better management of the entire loan and credit granting practice, the processing of portfolio risk, or the monitoring of open positions, with a forecasting perspective.

Banks and Financial institutions

The digitization of credit risk analysis processes constitutes an important competitive advantage in terms of:

- reduction in the time required for processing the file and disbursing credit;

- accurate and flexible elaboration of all the criteria of assumption;

- automated management of the PEF and of the analysis flows, based on customized criteria and parameters, to obtain a real-time verification in the process of evaluating the feasibility or otherwise of preliminary investigation of a case.

A cloud system, which does not require integration thanks to the numerous open APIs, and which allows maximum modularity and flexibility to better adapt to the procedures already in use.

Fintech companies

Tigran's process automation, as the first fully digital and integrated system for automation in the management of activities from an open finance perspective, to increase credit risk assessment capabilities:

- the electronic credit file, digital and integrated, in a single digital onboarding platform, which implements the automation of processes in the portfolio evaluation phases;

- the considerable increase in the ability of customers to grow their business volume;

- the adaptability of the platform to lending practices, which enable the user to offer access and use of multiple forms of financing, for the effective reduction of time-to-market and time-to-yes.

Evolve your credit risk management?

Try out the capabilities of a digital solution, discover Tigran Risk Platform to obtain a complete Rating-as-a-Service based on AI and data science technologies.

Fill out the formTigran Risk Platform FAQ

Why should I choose Tigran Risk Platform

The first all-in-one Rating-as-a-Service solution, which provides you with all the most advanced tools for data analysis, information processing and analysis, and forecasting with nowcasting trends, to allow you to bring your business strategy at a higher level, with more informed decisions.

In addition, Tigran is patented by modefinance in Europe, and this means uniqueness of the product and process optimization.

Which data do I find there

The availability of data, whether public or proprietary, available internally or via third-party data providers, will be uniquely integrated within Tigran thanks to the power of our APIs, for global access to data sources in a single system.

Given the sudden impact of the Covid-19 epidemic on businesses and the entire financial ecosystem, we deepened the analysis on forecasts and scenario simulation, releasing a series of intuitive but performative models and tools, sensitive to macroeconomic changes and global socioeconomic.

How does Tigran integrate with my systems

You won't be stuck with endless installations on company computers and internal systems: the Tigran Risk Platform is cloud-based, and you just need an internet connection to access it.

Or, for internal policies , you may need to install it on premise.

How long does the development take

Its unique modularity makes Tigran easily to develop; immediately, you can request a free demo access, within a few weeks you will have access to your platform, and if you need ad hoc developed modeling you can request it and work it directly together with our dedicated team.